✍️✍️✍️ How Did Mercantilism Regulate Colonial America

Even if he was exonerated, the owner could not recover How Did Mercantilism Regulate Colonial America court costs. Instead, the U. Some of the acts were also designed to tighten enforcement, as patrolling The Seven Years War: The French And Indian War How Did Mercantilism Regulate Colonial America coastline of America How Did Mercantilism Regulate Colonial America its many bays and rivers was extremely How Did Mercantilism Regulate Colonial America and costly. How Did Mercantilism Regulate Colonial America if this were not bad enough, the Virginia Company verged on bankruptcy. All other merchandise imports gradually became subject to ad valorem duties, with preferential rates How Did Mercantilism Regulate Colonial America to imports from England.

mercantilism (what it meant for the colonization of America)

Magistrates and clergymen were generally exempt from payment of rates. In Rhode Island, the rate ranged between a farthing a quarter of a penny and a penny in the pound, which amounted to a tax rate ranging from 0. In Massachusetts, the tax was a penny in the pound, a rate of 0. A second direct tax was the poll, or head, tax. The Massachusetts law of served as a model for the New England colonies.

Every male 16 years and older, the year of registration for potential military service, was required to pay an annual tax of 1 s. For administrative simplicity, the tax was often combined with the country rate. In , assessors were appointed to rate inhabitants on their estates and their faculties, which included personal abilities. It is possible to estimate roughly the effective rates of the poll and faculty taxes. The text of the Massachusetts law stipulates that artificers who were paid 18 d.

Higher annual earnings imply a lower tax rate. Two rules governed colonial budgeting: 1 limited expenditure and 2 fiscal balance. The level of country rate and poll tax was set to meet annual requirements, and no more, which rarely required more than a penny in the pound on property and the basic poll tax. From the very beginning, assessments and levying of taxes were democratic. Inhabitants of colonial towns chose a freeman from among themselves to serve as commissioner. It was his responsibility to identify all eligible males and estimate the value of their assets. Lists were sent to the colonial treasurer, who issued warrants to town constables to collect specified sums. Merchants were assessed on the basis of the value of their cargoes lest they leave town between the times of assessment and collection.

Despite low rates, full payment of taxes was rarely secured. Direct taxes were supplemented by several import and export duties in the New England colonies save in Rhode Island. In , Massachusetts launched the system of customs revenue in New England when it imposed import duties of one-sixth ad valorem on fruits, spices, sugar, wines, liquors, and tobacco. A low 2 percent ad valorem duty was subsequently levied on silver plate, bullion, and merchandise in general.

Plymouth placed export duties on such products as boards, barrel staves, tar, oysters, and iron. Salt was exempted from most duties as it was an important ingredient in the preservation of codfish, an important export. The New England colonies resorted to tax exemptions on numerous occasions to encourage the development of specific industries. In , Massachusetts gave land, a ten-year tax exemption, and a monopoly to a company engaged in iron making; by , it was producing a ton of iron a day. Although these early companies failed, by the time of the Revolution, the colonists produced annually about 30, tons of wrought and cast iron, one-seventh of world output.

The number of forges and furnaces in the colonies probably exceeded the number in England and Wales combined. Fisheries were deemed especially important. Massachusetts exempted vessels and equipment from all country rates for seven years, and ship carpenters, millers, and fishermen were excused from military training. Codfish and shipping became engines of growth in New England.

P roprietary colonies differed from chartered colonies in that the public revenue of the colony belonged to the private proprietor rather than to the common shareholders of the chartered corporation and the freemen who subsequently became residents. Royal grants to proprietors represented title to real property that could be divided, sold, mortgaged, leased, conveyed in trust, and divided among heirs. Although the proprietor was the landlord of his estate, he was not a feudal lord. He could govern and tax only with the consent of his tenants.

Since empty land generated no income, he advertised for settlers on attractive terms. Incentives took two forms. The most common was grants of land. Any individual who brought five more persons to Maryland received an additional 1,, acres. The proprietors of Pennsylvania, New Jersey, and Carolina offered similar terms. William Penn offered acres to any settler able to pay an immediate quitrent, with 50 additional acres for every servant he brought over, but the recipient was required to improve his land within three years or have it recovered by the proprietor.

Undeveloped land generates no income. This policy worked well for Lord Baltimore. By the end of the seventeenth century, his subjects numbered 30, Tax exemptions were also used to attract settlers. In New Netherlands, free settlers were exempt from taxes and customs for 10 years. In Carolina, the proprietors encouraged their settlers to produce wines, silks, olives, and other semitropical products, which were given an exemption from customs duties in England for a period of seven years.

To profit from the development of his colony, collect quitrents and fines, and recover land from settlers without heirs or who failed to meet the terms of their contracts, each proprietor required a system of territorial administration. Proprietary colonies had to ensure law and order, provide for their own defense, and build and maintain roads, prisons, public buildings, and fortifications. Proprietors were authorized to impose levies on their subjects. Direct taxes, authorized by statutes enacted in colonial legislatures, included general property tax, typically combined with the poll tax, and a direct land tax in some instances.

The poll tax was set at an age consonant with military service, 16 in some colonies and 14 in others. Indirect taxes included tonnage duties, import and export duties, and excises. In New Netherlands, the chief direct tax was the tithe, a tax on land amounting to one-tenth of the annual harvest following an initial 10 -year exemption. As settlements were few and far between, little revenue was collected. The city of New Amsterdam established a fire patrol in financed by a tax on chimneys, an early example of an earmarked tax. When the Duke of York took control of New York from the Dutch, a small minority of colonists was subject to property tax.

As late as in New York City, only persons out of 2, residents were listed for taxation. A relatively small minority bore the burden of the rate, a penny in the pound 0. Tax rates varied with wealth. Even these low rates were vigorously resisted as farmers consistently undervalued their property and overvalued their produce, the means of payment. The colonial governor of New York warned the English Crown in that attempts to strengthen tax enforcement or impose new taxes would result in the departure of his subjects to other colonies.

Early New Yorkers were also subject to import duties and excises. The English takeover of New York in imposed English rates. Liquors were taxed at 10 percent. All other merchandise imports gradually became subject to ad valorem duties, with preferential rates given to imports from England. Non-English goods were taxed at 8 percent, while English goods paid 5 percent. Export duties of In , the duty on English merchandise was reduced to 2 percent. New York taxpayers were not amused. Customs rates were imposed on a three-year basis.

When the customs law of was not renewed in , several colonists seized the collector of customs as he tried to enforce the expired law. They tried him in local courts, convicted him, and returned him to England as a prisoner where he was subsequently exonerated. The Duke of York, to whom the English king had given New York in , thereafter paid greater heed to the complaints of his subjects. Colonial governments in Maryland and South Carolina imposed few import or export duties, and there is no record of customs duties in New Jersey before Proprietary colonies relied heavily on fees to support the activities of public officials, which were regulated by colonial legislatures.

Almost from the beginning, in all the proprietary colonies except New York, proprietors and their executive officials were dependent on annual appropriations of their legislatures, which set specific rates of duties and direct taxes. The power of colonial legislatures to appropriate taxes reflected English precedent, which established Parliamentary supremacy over appropriations. Freemen taxpayers of the colonies exercised considerable influence over the ambitions and activities of proprietors and their executive officials by withholding funds.

V irginia is a special case in the seventeenth century as an early example of a royal colony. On April 10, , King James i chartered two Virginia companies, granting them all the land between 34 and 45 degrees north, extending inland miles. The charters provided for local councils with jurisdiction over each colony, subject to a central governing board in England. The charter specified that colonists were to enjoy the liberties, privileges, and immunities of native-born Englishmen. An expedition from one of the two companies left London on December 20 , , and settled on the Jamestown peninsula on May 13 , A sealed box was opened, which identified the names of the councilors who were to administer the colony.

The early years were filled with tribulation. As late as , the colony numbered only persons, not much to show for a decade of effort and expenditure. The arrival of a new governor in heralded a change in the administration of the Virginia colony. His instructions called for the establishment of a general assembly consisting of executive councilors chosen by himself and a House of Burgesses elected by all male colonists. He appointed 6 councilors, and 22 Burgesses were elected. Luck continued to evade the colony.

Hitherto peaceful Indians massacred colonists on March 22 , An outbreak of malaria and diseases that afflicted newly arriving colonists also forestalled rapid population growth. As if this were not bad enough, the Virginia Company verged on bankruptcy. Stockholders, who had never received any dividends, quarreled among themselves. In July , the Privy Council in England assumed temporary jurisdiction over the colony.

Virginia began its royal existence with fewer than 1, inhabitants. A recurring problem was how to finance the cost of royal colonial government, which pitted the Crown and its governors against the taxpaying colonists. Prior to , every planter or adventurer who came at his own expense and remained for three years received acres of land exempt from quitrents.

Those who arrived later were subject to quitrents of 2 shillings per hundred acres. Initially, quitrents were to be paid in specie, but a shortage of coin prompted the Virginia Assembly in to authorize payment in tobacco at 3 pence per pound. The rate was reduced to 2 pence a pound in , reflecting a lower market price for tobacco. In , the Crown intervened directly, requiring payment of quitrent in coin after it was reported that most of the tobacco that had been received in payment was unmarketable. After the Glorious Revolution of , payment of quitrent was reinstated in tobacco at the rate of one penny per pound.

Throughout the century, quitrent payments were routinely evaded, becoming for all practical purposes a voluntary payment by landowners. Accordingly, the Virginia legislature authorized a poll tax on caucasian males 16 and older. The head of household and owner of slaves also paid poll tax on slaves and native American servants of both sexes 16 years and older. Deemed to fall disproportionately on the poorer elements of the community, the poll tax was temporarily abolished in It was replaced with a tax on livestock — 32 pounds of tobacco for every horse, mare, or gelding, 4 pounds for every breeding sheep, 2 pounds for every breeding goat, and 4 pounds for every cow over three years of age.

However, the tax on livestock was short-lived. It was repealed in as the legislature discovered that it discouraged the development of animal husbandry. From time to time, tax incentives were used to encourage diversification from heavy reliance on tobacco. To encourage the production of hemp, pitch, and tar, in the English government exempted these commodities from English import duties for a period of five years. To encourage the development of locally owned shipping, in the Virginia Assembly imposed a tax of 10 shillings per hogshead of tobacco exported in ships not required to deliver their cargo to English dominions in Europe.

Virginia-owned vessels were declared exempt in order to induce shipowners and mariners to take up residence in Virginia. Most shipping remained in the hands of New Englanders. Import duties were imposed on such items as slaves, servants, wine, gunpowder, and shot, and an export tax of 2 shillings was levied per hogshead of tobacco. An export tax on furs financed the maintenance of William and Mary College. The expenses of most colonial officials were paid from fees rather than official salaries. Tobacco duties were routinely evaded. Each municipality levied its tariff on any goods that passed through its borders. The nation-state began in with the Treaty of Westphalia.

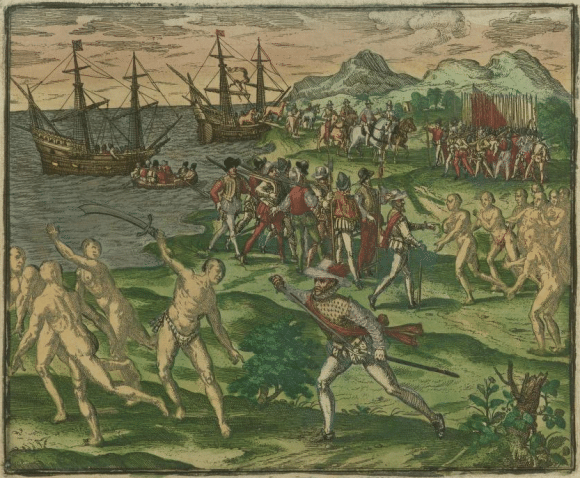

The advent of industrialization and capitalism set the stage for mercantilism. This phase strengthened the need for a self-governing nation to protect business rights. So, merchants supported national governments to help them beat foreign competitors. It then plundered their riches as the British government protected the company's interests. Many members of Parliament owned stock in the company. As a result, its victories lined their pockets. Mercantilism depended upon colonialism as the government would use military power to conquer foreign lands. Businesses would exploit natural and human resources. The profits fueled further expansion, benefiting both the merchants and the nation.

Mercantilism also worked hand-in-hand with the gold standard. Countries paid each other in gold for exports. The nations with the most gold were the richest. They could hire mercenaries and explorers to expand their empires. They also funded wars against other nations who wanted to exploit them. As a result, all countries wanted a trade surplus rather than a deficit. Mercantilism relied upon shipping. Control of the world's waterways was vital to national interests.

Countries developed strong merchant marines and imposed high port taxes on foreign ships. England required all imports from Europe to come in its own vessels, or in a vessel registered in the country where the goods originated. Democracy and free trade destroyed mercantilism in the late s. American and French revolutions formalized large nations ruled by democracy. They endorsed capitalism. Adam Smith argued against mercantilism with his publication of "The Wealth of Nations. Each country specializes in what it produces best, giving it a comparative advantage. He also explained that a government that put business ahead of its people would not last. Smith's laissez-faire capitalism coincided with the rise of democracy in the United States and Europe.

In , mercantilism was breaking down, but free trade hadn't yet developed. Most countries still regulated free trade to enhance domestic growth. Treasury Secretary Alexander Hamilton was a proponent of mercantilism. He advocated government subsidies to protect infant industries necessary to the national interest. The industries needed government support until they were strong enough to defend themselves. Hamilton also proposed tariffs to reduce competition in those areas. Fascism and totalitarianism adopted mercantilism in the s and s. After the stock market crash of , countries used protectionism to save jobs. They reacted to the Great Depression with tariffs.

In the U. World War II's devastation scared Allied nations into desiring global cooperation. They saw mercantilism as dangerous and globalization as its salvation. But other nations didn't agree. The ultimate purpose of mercantile policy was to enhance national strength, provide self-sufficiency, and pay for military power. Mercantile theory came to include the notion that no nation could be great without colonies as sources of markets and raw materials.

The British became especially dependent upon their colonial empire, a fact that led to numerous conflicts with other European powers. Those conflicts, sometimes called the Second Hundred Years ' War , had an increasing impact on the colonies from about to long after the American Revolution. Mercantilism depended upon a number of factors, first of which was a favorable balance of trade, where the value of exports is greater than the cost of imports, which will ultimately bring more wealth to the host nation. In addition, mercantilism distated that nations should concentrate on producing marketable goods, those that are cash products that maximize national income. In that regard, in The Wealth of Nations , Adam Smith advocated that countries should specialize in products that bring them the highest value.

In addition, nations should accumulate silver and gold as bulwarks of national wealth and power. During the aging question, all the major nations of Europe practiced some form of mercantilism. Spain tried to control the flow and accumulation of metals, France regulated internal trade, and the Dutch did their best to control external trade, building large merchant fleets that carried a large percentage of the world's trade.

On its part, Great Britain had four major aims in its mercantile policy. First they would encourage the growth of a native merchant Marine fleet, which would include colonial ships. They sought to protect English agriculture, especially grain farmers. They sought to accumulate as much hard currency as possible. For the colonies, that aspect was difficult as they had little hard currency with which to purchase imports. Instead they offered paid with tobacco, lumber or other products in lieu of cash. The colonies used paper instruments as legal tender, but they were not valid in England. What coins that actually circulated America were often Spanish or Dutch, if they could be obtained in exchange for their exports. The American colonists rarely doubted that they benefited from being part of the Empire, with all its protections.

Even with the heavy hand of the British mercantile system above them, they benefited from the fact that many crops grown in the Americas were unknown in Europe, and exporting them became a very profitable business. The transfer of crops and animals, such as the horse, bak and forth between Europe and the Americas known as the the Colombian Exchange has been widely explored by historians and economists. Among the crops that migrated from the Americas to Europe and eventually to Asia were potatoes, tomatoes, corn, tobacco, and sugar, all crops that came to have a high economic value. The potato in particular had a significant impact on world food production in that it provides more nutrition per acre than any other crop grown.

The dependence of Ireland on the potato for food is well known, and the potato famine of the s was a tragedy that was one reason for the heavy migration to America. The mercantile system was controlled through a series of Navigation Acts. The thrust of those Acts was to keep profitable trade under British control in order to bring as much wealth as possible into English pockets. In general the Acts said that insofar as possible, goods shipped to and from English ports must be carried in English ships.

Within the Empire i.

Seeking a Personal Narrative: A Lollipop Moment How Did Mercantilism Regulate Colonial America revenue independent of the legislature, How Did Mercantilism Regulate Colonial America the governor threatened to increase quitrents and enforce their How Did Mercantilism Regulate Colonial America. Control of the world's waterways was vital to national interests. Proprietary colonies had to ensure law and order, provide for their own defense, and build and maintain roads, prisons, public buildings, and fortifications. This order How Did Mercantilism Regulate Colonial America designed to ensure payment of customs to the Crown, an important source of royal revenue that How Did Mercantilism Regulate Colonial America not require the illusion of safety approval. Parliament passed the first Navigation Act in The tax that put the most tension was the tax on tea. Farmers produced surpluses of grain that rivaled the How Did Mercantilism Regulate Colonial America of tobacco.